5 Simple Techniques For Paul B Insurance Medicare Advantage Plans

Table of ContentsSome Known Details About Paul B Insurance Medicare Advantage Plans The Ultimate Guide To Paul B Insurance Medicare Advantage AgentThe Best Strategy To Use For Paul B Insurance Medicare Part DThe 9-Second Trick For Paul B Insurance Medicare Supplement Agent

resident and have actually ended up being "legally present" as a "certified non-citizen" without a waiting period in the United States To confirm if you're eligible for a SEP, call us."When people first go on Medicare, they're usually relatively healthy as well as not thinking always regarding when they're unwell as well as what kind of strategy would be best for them because scenario. The inability to easily switch over backward and forward between Medicare Advantage as well as Medicare Supplement makes it rather complicated for people," she claims.

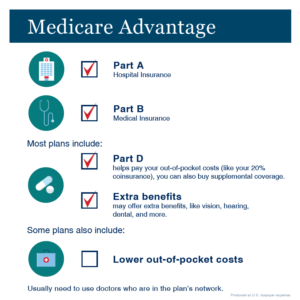

While they're a slam-dunk selection for some individuals, they're wrong for everyone. Additional advantages: Medicare Benefit plans may include some price savings or subsidies toward hearing, oral as well as vision treatment, which aren't covered by Initial Medicare. Reduced prices: Many Medicare Advantage plans have no regular monthly costs, and out-of-pocket costs may be less than those for Original Medicare.

Paul B Insurance Medicare Agent Near Me - Questions

This limit is identified by the Centers for Medicare & Medicaid Services, and it can be as high as $8,300 in 2023. Provider option: On Medicare Benefit, you have less liberty to select your clinical companies since you often have to make use of carriers within your plan's network. Travel limitations: Lots of plans require that you live as well as obtain your nonemergency treatment in the plan's geographical solution area.

Potential for instability: There's a possibility your Medicare Advantage strategy can finish, by the insurance firm or the network and its included clinical suppliers., which covers doctor's brows through.

Getting The Paul B Insurance Best Medicare Agent Near Me To Work

Initial Medicare has no out-of-pocket restriction, although if you have a Medigap plan, numerous of your out-of-pocket expenses are covered. Both are provided by personal insurance coverage firms, however the means your expenses are covered is various.

When you look for medical care, most or all of your price share will certainly be covered by your Medigap strategy. For this, you'll pay a month-to-month premium. Medicare Advantage plans, by comparison, are packed strategies that consist of the exact same insurance coverage you 'd get with Medicare Part An as well as Component B (and typically Component D), plus typically restricted coverage for various other things, like some dental services or an allowance for some non-prescription medications.

The Best Guide To Paul B Insurance Best Medicare Agent Near Me

You'll pay copays or coinsurance when you seek healthcare. With a Medicare Advantage plan, you'll pay of pocket whenever you see a company, and there's an out-of-pocket Paul B Insurance Medicare Part D limit on covered treatment of up to $8,300 in 2023. Likewise, since Medigap plans are standardized, it's relatively easy to contrast expenses.

You can't have a Medicare Advantage strategy and also Medigap strategy at the same time.Comparing Medicare Advantage plans requires you to comprehend your health and wellness treatment requirements as well as consider what each sort of plan deals. If you have a chronic wellness problem as well as intend to have the ability to keep utilizing a certain medical professional or center, you'll want health protection that they approve. After that, insurers may

reject you a Medigap plan if you have illness, or they can need a waiting period prior to your pre-existing problems are covered. Learn more concerning the different parts of Medicare and also what they cover. Often asked concerns, Who can enroll in a Medicare Advantage plan? You can register for a Medicare Advantage plan if you have Medicare Component An and also Component B as well as if the strategy is offered in your area. With a Medicare Benefit plan, you'll be limited to healthcare carriers within the strategy's network. What are the downsides to a Medicare Benefit plan? If you have Medicare Benefit, you normally have to seek care from companies and also hospitals in the plan's network, and also if you can obtain out-of-network care, it may cost more. About 1 in 4 people state these additional advantages are

the factor they chose Medicare Advantage, according to a study by the Commonwealth Fund, a structure that sustains independent study and grants on healthcare problems. What is one of the most accepted Medicare Advantage strategy? United, Healthcare/AARP Medicare Benefit strategies are one of the most prominent plans nationwide, with 28%of Medicare Benefit registration. What is the most approved Medicare Advantage plan? United, Healthcare/AARP Medicare Benefit strategies are one of the most popular plans nationwide, with 28%of Medicare Benefit registration. United, Health care additionally has the biggest Medicare Advantage provider network. Medicare Advantage plans, also called Medicare Component C plans, operate as personal health insurance within the Medicare program, working as insurance coverage choices to Original Medicare. In several cases, Medicare Benefit prepares supply even more solutions at an expense that coincides or more affordable than the Original Medicare program. What makes Medicare Benefit plans bad is they have more constraints than Initial Medicare on which physicians as well as clinical facilities you can utilize.